For anyone wishing to ensure financial security, including university students, it is important that they plan how they use, save and invest their money. We spoke with some of the students to share with us how they plan to manage their personal finances this semester.

By Yvonne Mutesi

For me, I’ll manage my finances this semester by cooking my own meals, saving weekly in my SACCO for my goals, and keeping a simple budget so I don’t overspend.

Rachael Grace Namyenya, Bachelors in Human Nutrition and Dietetics

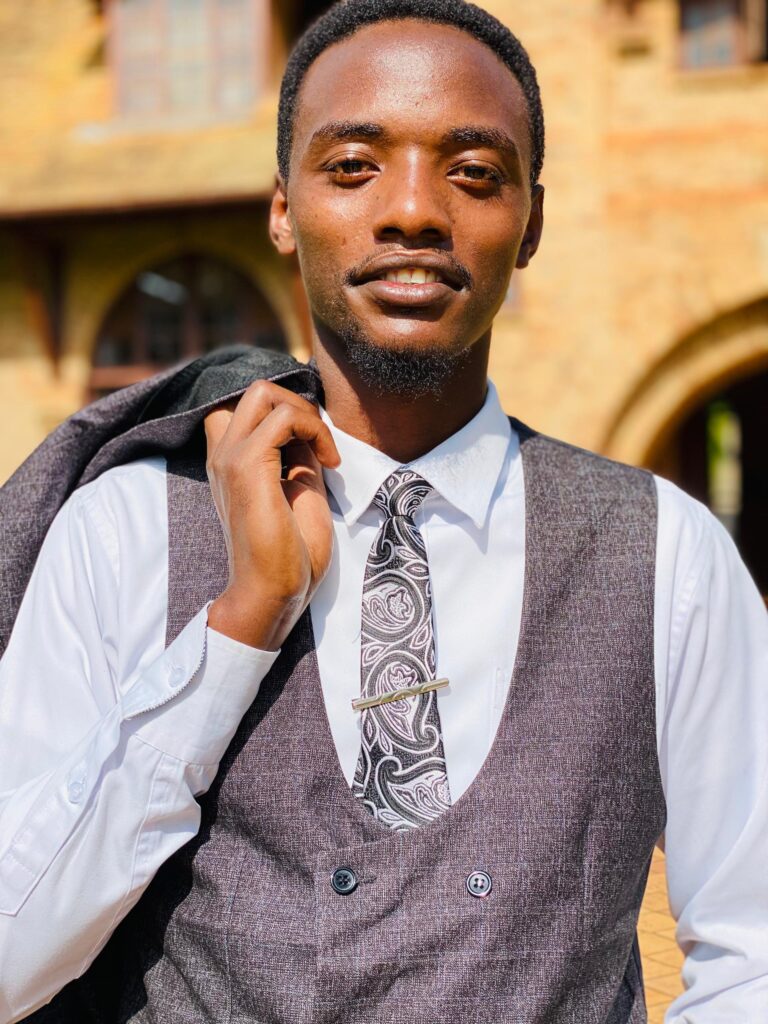

I have a task of budgeting for the little money I come with for the new semester because I am not assured of receiving money anytime I want. Secondly, sacrifice and be sharp. Last but most important is tithing. Tithing is a good financial discipline, and it attracts God’s favour and wisdom on how to build your income. These are principles that will guide my financial discipline, and I am hopeful to be a good steward of the little I have.

Aggrey Rwerinyange, Bachelor of Laws

This new semester, I plan to manage my personal finances by first making a budget. For example, I will set aside money for important needs like tuition, rent, food, and transport before spending on other things. I also want to avoid unnecessary expenses, like eating out too often, and instead cook for myself because it is cheaper. I will also save a small amount every month, even if it is a little, so that I can have something in case of emergencies.

Frank Zimba, Bachelor in Procurement and Logistics Management

This new semester, I plan to manage my personal finances by creating a clear budget that prioritises essential needs such as tuition, rent, food, and transport before allocating money to non-essentials. I will track all my expenses weekly to avoid unnecessary spending and make adjustments where needed. To increase my savings, I intend to cut down on impulse purchases and focus on affordable alternatives like cooking at home instead of eating out.

Aisha Magumba, Bachelor of Social Work and Social Administration

As a student, firstly, I draw my budget including income, expenses, and savings. This includes knowing the income (upkeep) you have and prioritising the saving part over the expenses, followed by the expenses. Secondly, saving for emergencies as a student in my third year — this will be a minimum of Shs20,000 weekly, as a must. This can be done by cooking some meals for myself, like dinners, to avoid large expenses on food.

Ruth Nakityaba, Bachelor of Social Work and Social Administration

As I step into my second year of nursing at UCU, I’m fully aware that balancing a heavy academic workload with financial responsibility is crucial. My plan is centred on a simple but effective strategy — proactive budgeting. By tracking every shilling I earn and spend, I can prioritise essential needs like textbooks and transport while being mindful of discretionary spending. I’ve also found that a key part of this is being smart about food—planning meals and cooking at home instead of relying on expensive takeout.

Tracy Kisakye, Bachelor of Nursing Science

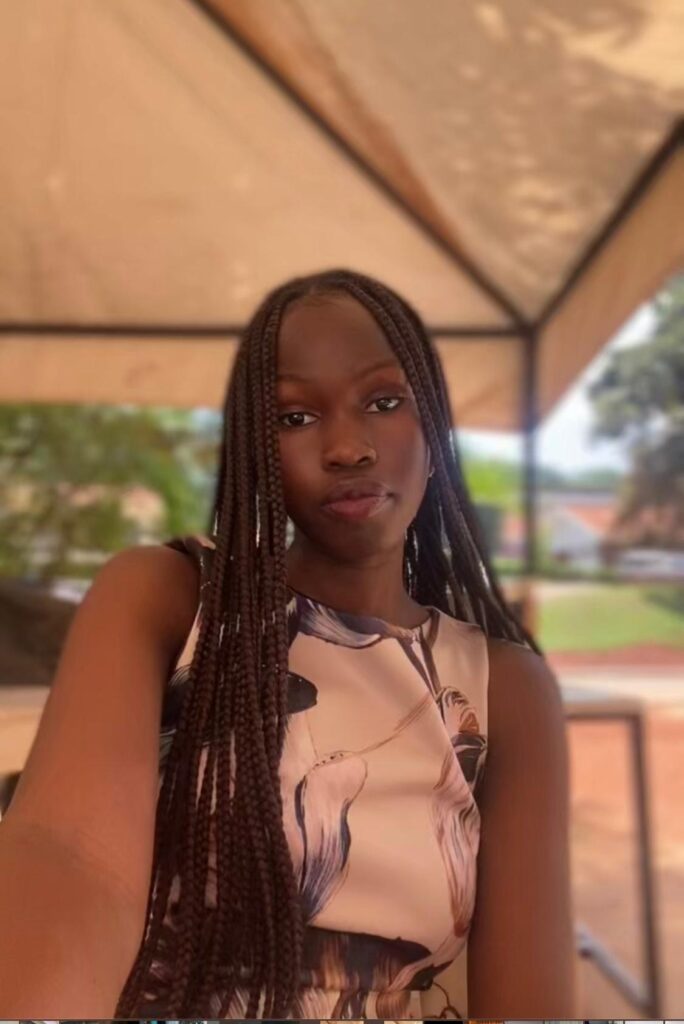

I am planning to start a small business that I will be running mostly online and then take savings seriously. I will make sure I budget with purpose so as to avoid wastage since the economy is tight. I will track my expenditure and expenses so that I am able to plan well and also invest in a small business like selling jewelry, thereby expanding my income that may help me throughout the semester.

Buchey Can Alak, Bachelor of Social Work and Social Administration